Most recent news & cracking headlines The occasions and also the Sunday Times

Usually, you need to stop accepting bucks repayments to your client account inside reference to transactions. The risk of which occurring, along with the regulation set up from the practice to quit it going on, will be mode element of their PWRA. It can benefit rare the brand new audit trail away from money if the bucks is sent to the consumer, onto an authorized, or committed to some way. Transmits out of a property in one manager to another without having any exchange away from financing, will get expose an equal risk to your purchase of property. According to law enforcement regulators plus the federal chance analysis, the brand new sale and purchase of home is a very common approach to possess losing or changing violent proceeds. Additional factors to take on are the value, difficulty and you may nature from operate in these types of components from the context of your own client and/or perhaps the nature of one’s functions that your particular habit usually undertakes.

Guaranteed Gains Ties (Uk Discounts Securities)

Amanda Bellucco-Chatham are an editor, blogger, and truth-examiner which have several years of feel comparing individual fund information. Otherwise do you want an alternative repaired price ISA? Present qualified Pursue checking customers is also refer a buddy to lender that have Chase and you will earn a funds added bonus. All of our Chase College CheckingSM account has great benefits for college students and the newest Chase examining consumers can enjoy it special provide.

Short term highest balance

The higher the chance, more total and you will legitimate data you receive might https://happy-gambler.com/netbet-casino/30-free-spins/ be. The sort of files acknowledged to confirm SoW otherwise SoF would be to trust the amount of ML/TF chance exhibited because of the customers. Controls six(1) talks of ‘the newest helpful owners with regards to a trust’ as the settlor, the new trustees, the newest beneficiaries (or category of beneficiaries) and any person who’s control of the newest trust. In which such things occur, reasonable actions might be delivered to be sure the new name of your useful proprietor/s of your trustee. When you are educated by the anyone involved with a preexisting believe to indicates with regards to it, you should offer their CDD on the trust’s helpful owners. Nonetheless, you really must be met which you have an overall comprehension of the new possession and you can handle structure of your own customer organization.

- Even in the unlikely knowledge the institution goes under, your own deposit harmony is secure around $250,one hundred thousand.

- These tips range between interview with compatible anyone along side practice, and you will reviews of the latest consumer/matter chance examination to determine if they have a keen impact on the overall threats on the habit etc.

- This is for example related where vehicle is utilized to hang assets or is employed in transactional or other potentially highest-exposure issues, or however, in which zero noticeable team activity will be computed, out of web sites searches and other provide.

- An educated highest-yield checking account speed is actually 5.00% APY, offered by Varo Financial and AdelFi.

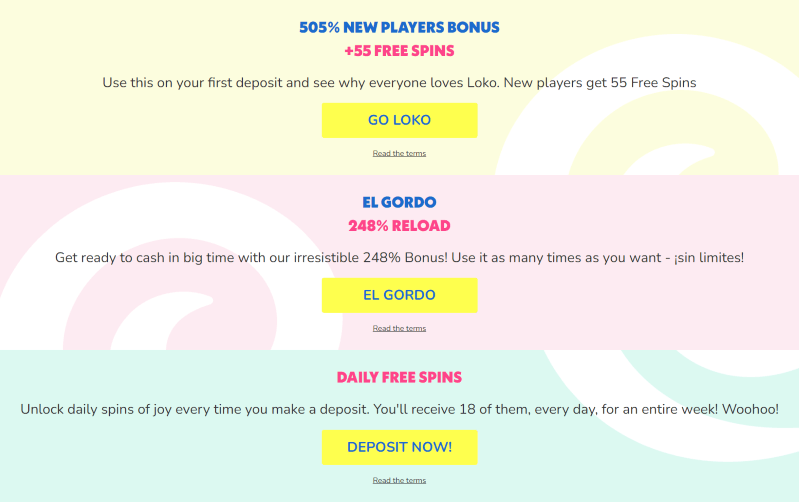

- It’s a straightforward means to fix possess platform’s performance and possibly even get an earn before you make the first put.

Remember that it is extremely an offense to conspire, incite or attempt to launder the brand new proceeds out of offense, or to guidance, support, abet or procure money laundering. The fresh incapacity to reveal provisions inside the part 330, area 331 and area 332 use where details about and therefore the data otherwise suspicion is based stumbled on a man to the or next go out. It creates both some substantive currency laundering offences (dominating offences) and you will a reporting routine making it an offense so you can fail to disclose education otherwise suspicion of money laundering (inability to disclose offences). Less than controls 88(3), it is an offence to reveal information in the contravention of a great associated specifications. Along with the offense away from breaching another requirements, the new laws include offences away from prejudicing analysis and revelation offences. Usually in which a supervisor undertakes administration step up against a habit, it’s her regulatory energies they are going to play with, unlike a power listed in the new laws and regulations.

While you are in any question concerning whether lawyer right enforce relating to the case the place you work, you will want to find independent legal advice in your choice-making techniques. The usage of legal professional privilege is frequently advanced and you may fact delicate. This is simply not, although not, an alternative to reveal writeup on all the case rules and regulations relevant to a certain situation. Equivalent tensions and happen with regards to the Terrorism Play the role of so you can whenever LPP can be applied and you will suppresses revelation beneath the relevant legislation. The new extent that LPP links in order to an excellent notary’s facts was not the main topic of an appropriate choice within the The united kingdomt and you will Wales that is an enthusiastic growing area of laws.

Numerous savings membership

You should inquire whether the digital supplier have degree or assures like this – and also the reasons why once they do not – prior to becoming a member of their features. Deeper tech precision will likely be used in higher risk ML/TF issues, and you can however, all the way down risk ML/TF things get enable entry to options having low levels of warranty to your purposes of basic homework. Businesses need to are still conscious of (and you can take into account) the truth that particular electronic confirmation offer rely entirely on the in public places filed and uncontrolled guidance, recorded individually from the individual otherwise source subject to the person. All the more, using other good research, for example biometric personality can be a good way of cutting such dangers. It must be noted you to definitely most other possibilities, which do not fully comply with certain requirements above, can be utilized as part of a room away from systems and controls, which in integration meets the needs of control twenty-eight.

Invest fee-free on vacation.

The fresh NCA offer a protection up against money laundering (DAML) costs or terrorist funding, commonly known as “consent”. The brand new UKFIU features wanted to expose an analytical password (an excellent subset of glossary codes) to have “technical” breaches you to an appropriate habit get run into inside the transactional works. While the MLRO, you need to know every piece of information given, query after that issues if necessary and you may imagine if or not you have a training or uncertainty of money laundering or radical money who would, subject to right, want a great SAR to be filed. You will have a process for personnel to help make the MLRO alert if they have knowledge otherwise a suspicion of money laundering.

Part 21D tipping of offences: regulated market

These types of sanctions are authored on the law, and you may conformity with them is actually compulsory, albeit outside of the regulations. UK-based techniques would need to accept her ongoing track of the newest issues it operate for the, even if a worldwide place of work is even needed to exercise. Relevant people in the newest behavior need to have entry to this informative article, particularly the MLRO/MLCO.

You should bear it at heart whenever examining geographical threats and you can whether or not a person or amount can get encompass a top risk jurisdiction. At the same time, connection with involved in a premier-risk legislation might help strategies to spot threats, when you are people with only a small exposure will get use up all your such feel and could not be able to accurately identify dangers. For the avoidance of doubt, prohibiting clients away from beyond your Uk or that aren’t UK-nationals, is not a requirement of your laws and regulations. Being exposed in order to a nation comes with offering functions, facilitating a matter of otherwise which have customers created in one country.